Reconciliation

The reconciliation extension helps you keep track of the reconciliation state of your accounts. There are 3 possible states:

- Does not need to be reconciled

- Reconciliation required but not reconciled

- Reconciliation required and reconciled

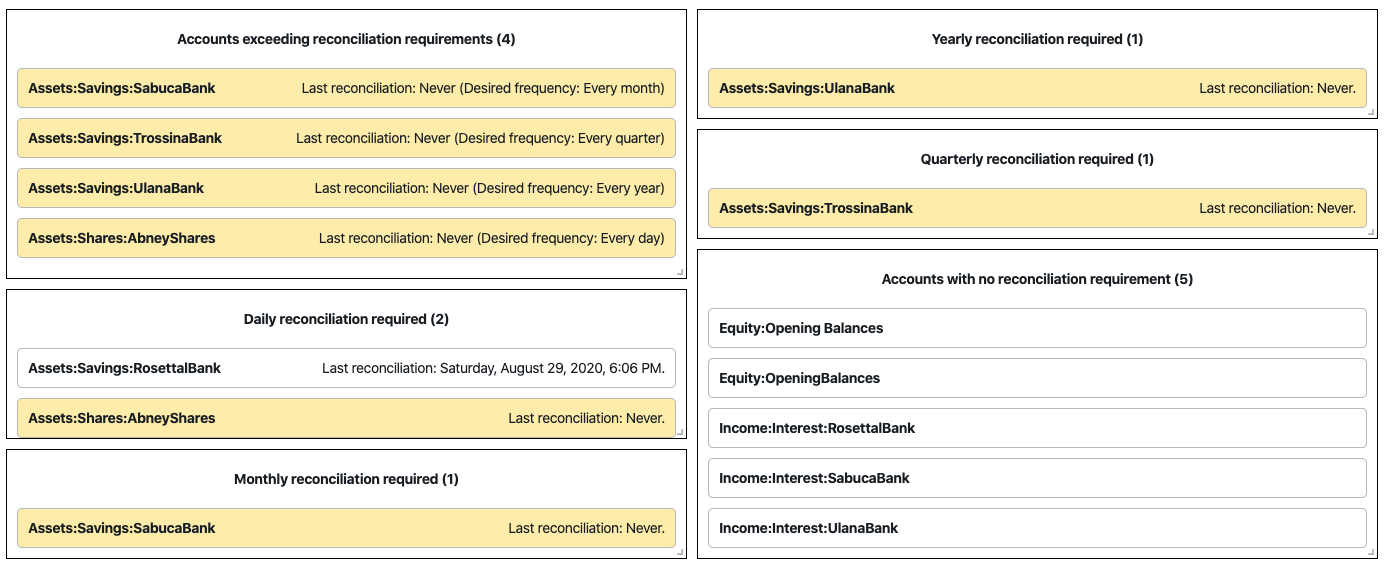

This extension presents a visual representation of the above states along with information on the frequency required of certain accounts:

In the above visual, we see 5 groups show accounts that are not currently reconciled, accounts that require daily, monthly, yearly reconciliations and accounts that do not require any reconciliation at all. Accounts that are reconciled within its frequency duration are present but not highlighted (Assets:Savings:RosettaBank).

If you wish to change the frequency of any account, or mark any account as reconciled, click on the account to access its attributes.

The extension respects the scope defined by the current analytics period scope:

The

Allscope is recommended as the period scope limits result based on transactions that occured within the scope. HavingAllwill ensure that all accounts will be included, unless you have a need to scope based on year or month for some reason.